Banking institutions do not care plenty regarding how large your income examine try. What they are shopping for is actually for employment balances that can guarantee that you earn a stable inflow of money. You really have increased-than-average month-to-month paycheck, but when you dont show your work safety towards lender, your chances of delivering recognized are narrow.

For these finance companies, financing in order to an individual who doesn’t always have a reliable jobs represents a noteworthy risk, particularly if the applicant is trying to help you obtain over 80% of one’s property’s rates.

Particular might think that a position really should not be problems more once the finance companies curently have the house due to the fact shelter. Although not, these lenders want to avoid to help you taint their trustworthiness by permitting some body in the place of a reliable source of income so you can use a hefty level of houses loan. They have the responsibility as prudent for the judging an individual’s capability so you’re able to provider a mortgage. In addition to, attempting to sell the house is always the last resort for those finance companies to recover from the losings is its individuals standard on the financing.

Just how do banking companies determine work?

Your own financial takes into account numerous facets when evaluating your own a position. For 1, it look at the duration of your time on your own current work and you will world. This allows them to measure the balance of your a job. The fresh new expanded you’ve been on your own latest business otherwise world, the more practical you look with the prospective bank.

Loan providers may also look at your other sourced elements of income, particularly if you are getting more than simply a monthly salary from your employer.

Along with your earnings, your a job standing along with things to help you financial institutions, especially if you commonly a typical complete-go out worker.

Finance companies will exert an effort to examine the field you are located in, studying the monetary trend within people in your field. Is people from a similar world more prone to home loan worry? What’s the rates away from financial delinquencies around experts from the exact same business?

Just how can various other a job versions affect your residence-loan application?

When you have an entire-date business, then it is already a now that you’ve got a higher risk of bringing home financing. However, for many who belong to the next a career sizes, you may want to work out caution and place out so much more energy to be certain loan providers recommend the application.

step one. Contract experts

- Subcontractors: They usually work with mining and you can construction areas. They typically do commissioned jobs and can be used for the an excellent pay-as-you-wade (PAYG) foundation or because notice-employed.

- Payg builders: Such employees are operating for the a predetermined label through a company. As a result the firms retain the taxation. Pay-as-you-go builders also are permitted an equivalent masters and repayments one typical staff member keeps.

- Business company: The individuals less than these kinds are not experienced employees. These people possess their inserted company and you may delegate to organizations and enterprises. They could be also entitled self-working builders.

- Freelancers: Talking about those who receives a commission towards a production-foundation. They are used in multiple tactics.

Finance companies remove package professionals the same exact way it beat informal team. Simply because can be found in a somewhat unpredictable work plan, banks tend to view these types of pros due to the fact risky.

When implementing, banking companies requires one to let you know not merely evidence of their income also http://www.paydayloancolorado.net/starkville/ your future work balance.

2. Self-functioning

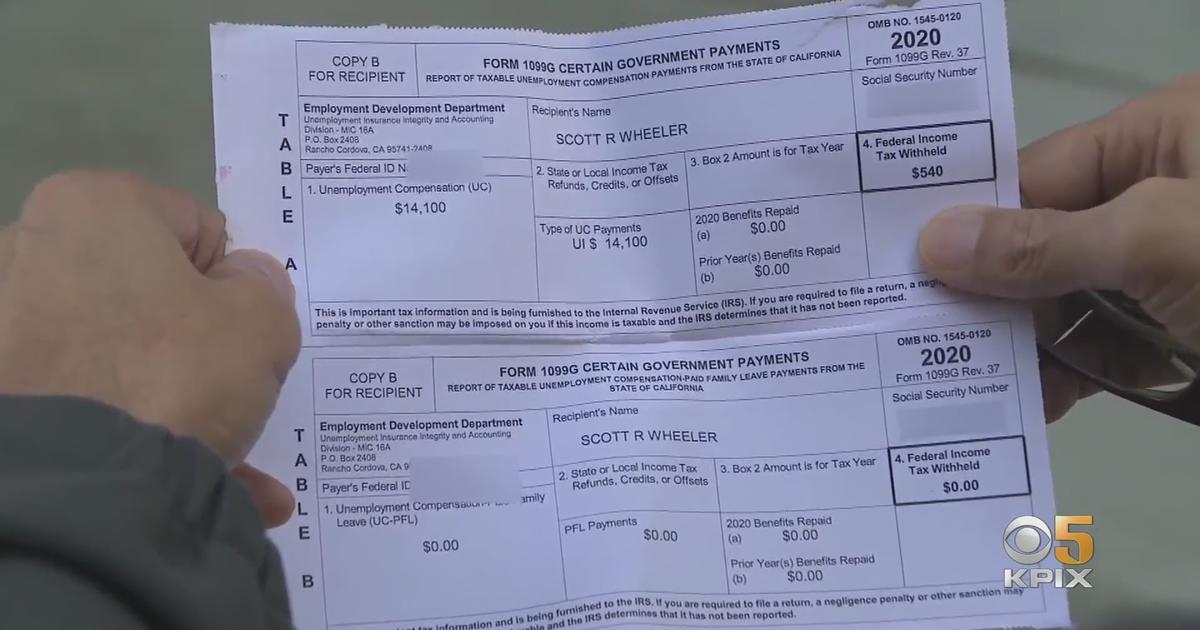

Self-functioning borrowers are necessary for banking companies to settle the latest exact same a job position for around a couple of years in advance of applying. Lenders could well be making use of your earlier in the day tax statements to evaluate the ability to provider the cost. They are very types of on course of your earnings, especially if you will find drastic decreases along the early in the day decades.